Last week was surprisingly quiet, with markets remaining mostly level week over week. There was a bit of intra-day volatility, but on the week the 2-year T-bill was down 4 BPS and the 10-year was up just 1 basis point. It’s likely that this week will be more volatile, with the Fed meeting on Wednesday, JOLTS Tuesday, ISM numbers Thursday, and monthly payroll numbers on Friday.

PCE numbers came in-line with expectations, so they didn’t impact the market much. GDP numbers came in lower than last quarter but still slightly higher than expected at 2%. There was a 5-year Treasury auction last week that went very poorly, as the government continues to auction off record amounts of debt. Employment numbers were strong, and inflation continues to tick down.

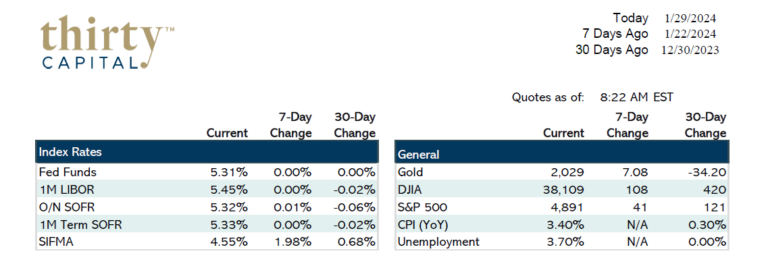

It feels as if the market is still getting a pulse on the Fed, and we may be range-bound within a 10-15 BPS window until we get more clarity from Powell. They’re expected to hold steady on Wednesday, but there will certainly be lots of chatter about what Powell says during his speech. SOFR should also remain range-bound around 5.30 until further notice.

There will be a lot of talk in the coming months about oil prices. It’ll be much more difficult for the Fed to justify cuts if we start to see oil prices spike. Considering current geo-political issues, there is concern that tensions in the Middle East could drive increases with inflation.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!