Last week, the curve steepened following a significant selloff. 2-year Swaps came up 14 BPS, and 10-year Swaps rose by 23 BPS over the course of the week. This movement was driven by last week’s inflation data and impacted by payroll data from the week prior as well. Both Core CPI and the Headline number came in as expected, but there weren’t signs of improvement. YoY headline CPI ticked slightly higher, which was expected. We got a strong PPI read to follow, and 2/3 TSY auctions were met with strong demand.

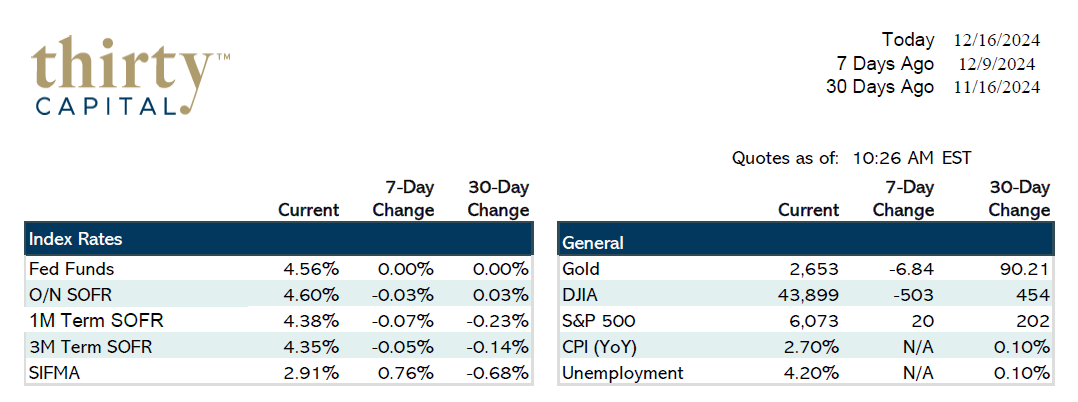

Retail Sales data comes out tomorrow, which will be the last major reading prior to the next Fed meeting. Even considering recent data, there’s an overwhelming expectation that the Fed will cut 25 BPS on Wednesday. This is evidenced by the gap between Overnight SOFR and 1M Term SOFR. This will be a full release with new dot plots and economic projections in addition to the rate decision, and new PCE data will be released on Friday. Their tone is expected to be hawkish, which could drive yields for the remainder of the year. Roughly two additional cuts are being priced in next year.

There are several reasons to believe there’s added pressure on long term rates. If Trump & his team execute on many of their campaign promises (i.e., tariffs and deportation), the belief is that long-term yields will rise sharply. Many sophisticated traders think the Fed is wrongly focused on the jobs mandate rather than the inflation mandate. The resurgence of inflation is viewed as an “Armageddon” scenario for central banks. For this reason, it’s reasonable to expect increased volatility through the end of the year.