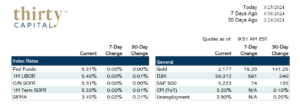

Last week, the 2-year and 10-year Treasury yields dropped 14 & 11 BPS, respectively. An interesting tidbit in the news was the Fed meeting, specifically Powell’s tone. He was more accommodative than expected and didn’t explicitly shut down the notion of a cut in May or June. He noted that policy makers would be sensitive to unexpected deterioration in the labor markets.

The updated dot plot still shows 75 BPS of cuts this year but a slightly higher neutral rate beyond 2024, which is a revision upward. Fed funds futures remain more aggressive than the Fed’s dot plot.

This week, we have an early close on Thursday, and the markets will be closed entirely on Friday. This is interesting, considering that GDP figures are coming out on Thursday and PCE figures on Friday. This could lead to some chaos next week. We’ve seen two consecutive months of hotter-than-expected CPI/PPI figures, so the PCE release will be watched closely.

SOFR rates remain level. The market was concerned last week that the Fed would change paths on their policy statement, but they stuck to their guns, which is ticking rates up as a result.

Tomorrow, we have $67B in 5-year Treasuries being auctioned, followed by $43B of 7-year Treasuries on Wednesday. The Treasury continues to sell massive amounts of debt, and the market will certainly be watching how these are absorbed. There will also be a lot of Fed speak worth following this week.

The Fed will look to taper off the shrinking of its balance sheet. They could start as early as June, which the market already appears to be pricing in. They’ll continue to shrink in smaller amounts, hoping they can do it for longer and wind up with a smaller balance sheet in the long run.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!