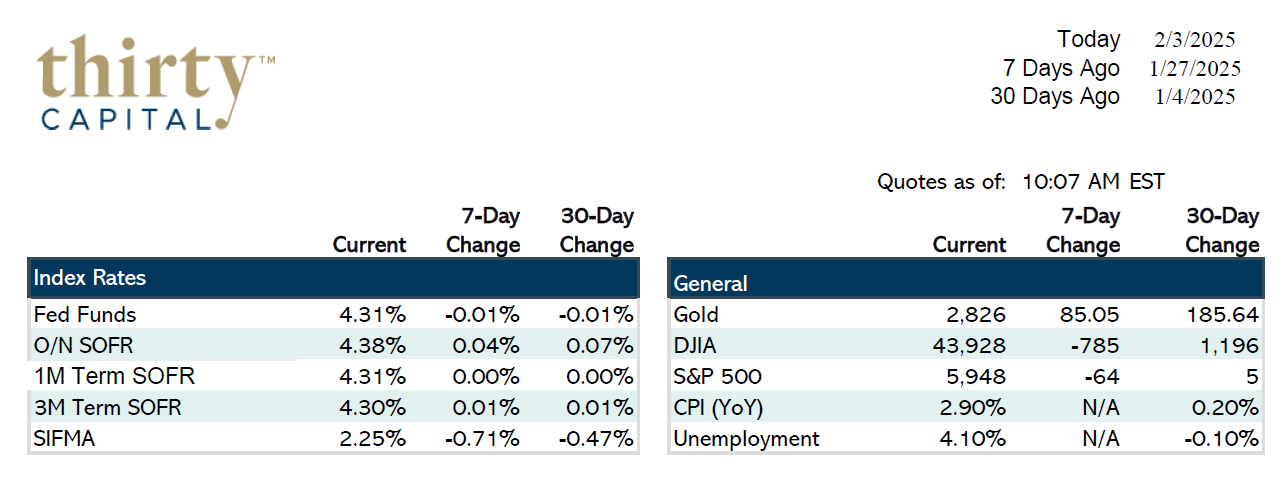

The last week of January was eventful, marked by sizable Treasury auctions that were well-received by the market. The week’s biggest event was Wednesday’s FOMC meeting, where the Fed unanimously voted (12-0) to keep interest rates unchanged. There was no updated dot plot, and Chair Powell signaled a balanced stance, suggesting the Fed remains in a holding pattern. The market, however, is pricing in one rate cut by mid-year and a potential second cut before year-end.

Thursday’s economic data included initial jobless claims and GDP, both coming in solid. The second major data release of the week came on Friday with the PCE report, which met expectations across the board. Core PCE came in at 0.26%, annualizing to a rate in the low 2% range—very close to the Fed’s target.

Looking ahead, this week’s focus will shift to jobs, with JOLTS data on Tuesday (expected to soften to 8 million openings), ISM Manufacturing and Services reports on Monday and Wednesday, and the key Nonfarm Payrolls report on Friday. The unemployment rate will also be closely watched.

Over the weekend, new tariffs made headlines, raising concerns about potential inflationary effects. While tariffs are generally seen as inflationary, last week’s bond market reaction—yields softening by 6-8 bps across the curve—suggests that the impact might not be significant. The strengthening dollar could also counteract some inflationary pressure, but market volatility remains elevated. There’s ongoing speculation about whether the Fed may ultimately cut rates more than they are currently signaling.

Real Estate & Capital Markets

In the multifamily sector, insights from NMHC suggest that an existing supply overhang will lead to increased concessions, though rental demand remains steady. The market appears reasonably balanced, allowing for steady rent increases.

On the debt side, construction lending is making a comeback, and bridge loan spreads are tightening. Fannie Mae has started the year aggressively after losing $11 billion in production to Freddie Mac last year. Meanwhile, equity markets remain strong, with sponsors able to raise capital with relative ease—investors are waking up and actively exploring new opportunities.

Additionally, the latest tariffs apply to the U.S.’s three largest trade partners, with previous exclusions now removed. The broader impact on markets remains uncertain, but investors will be watching closely.