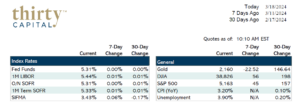

Last week was very eventful. 2-year and 10-year Treasury yields jumped up on the week 25 and 23 basis points, respectively. It was a slow grind with the rate movement coming gradually throughout the week. Tuesday’s headline CPI figures exceeded expectations (3.2% actual vs. 3.1% expected) which brought rates up about 5 basis points. PPI is figuring it exceeded expectations as well which continued the upward trend for rates.

The expected number of cuts per Bloomberg’s World Interest Rate Probability model is now down to 2.9 with the probability of a June cut down to about 60%. This Wednesday around 2:00 PM EST we’ll hear the results from the 2-day FOMC meeting. They won’t do anything with rates but the rhetoric to follow will dictate what happens in the markets. Aside from this meeting, the focus this week will be on Housing and Central Banks.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!