Last week we had strong Treasury auctions (2’s, 5’s, & 7’s), which suggests strong interest in the short end & belly of the curve. Rates treaded water for most of the week, but we did see a bit of a move-up on Thursday in advance of Friday’s PCE figures, as well as a sell-off on the long end. PCE figures came in right on top of expectations, at 2.6% on Friday.

This week we have a lot more data and other items to watch. ISM Manufacturing numbers come out today, which are expected to be restrictive but stronger than last month. JOLTS data will follow tomorrow, which will be closely watched, as this figure came in softer than expected last month. ISM Services will follow on Wednesday, but Friday’s Payroll numbers will likely be the biggest data point of the week. Last month we saw a surprising blowout figure, so any revisions will be interesting to watch. $190,000 is the expectation for this month’s release.

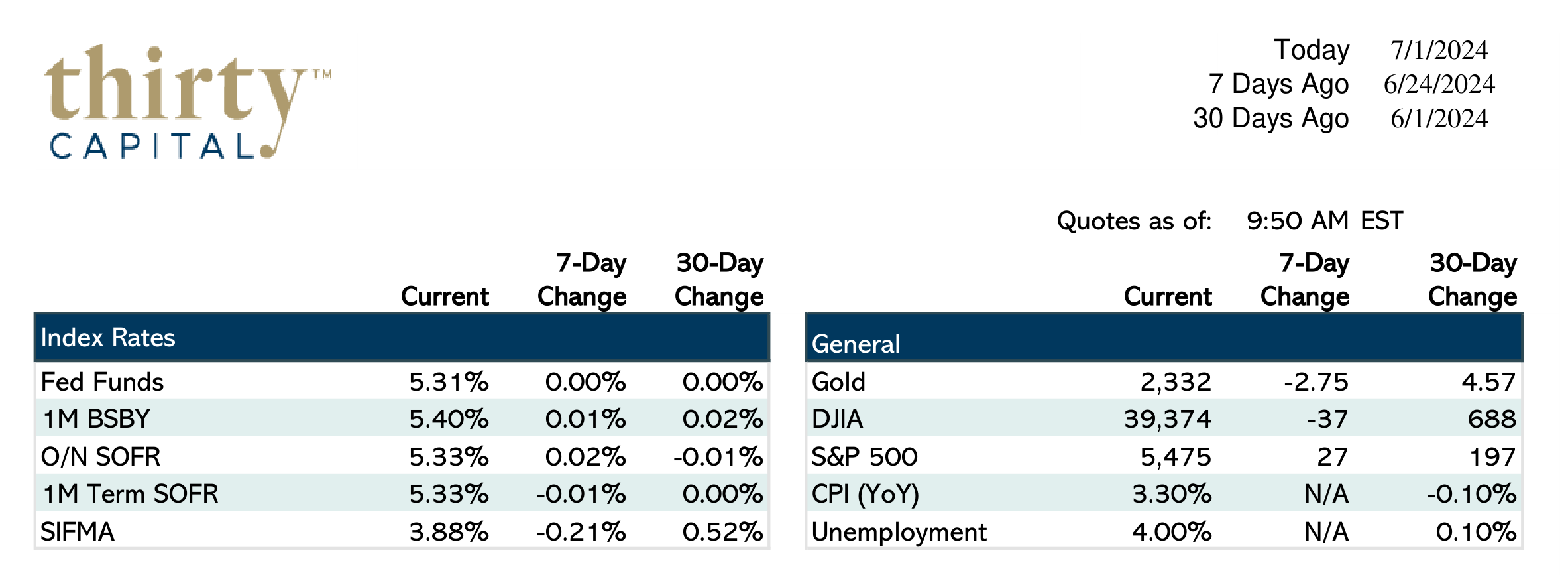

Unemployment is expected to remain steady at 4%, which is key with everyone watching the Fed and trying to determine timing for their moves. They’re expected to begin the cutting cycle once inflation comes down, but if jobs start to weaken, they may be motivated to move more quickly as well. Powell, along with other Fed speakers, will be speaking this week, which will be watched closely for clues.